Sudan’s Paris Summit: great long term benefits, terrible short term detriments

25 May 2021

Last week’s Paris Summit has paved the way to ease Sudan’s foreboding foreign debt and opened channels for investment, participants told Ayin, but economists are also wary of this reliance on foreign funds, fearing more difficult days ahead for Sudan’s citizenry.

The Paris Summit represents a key step in Sudan’s plans to follow the International Monitory Fund [IMF] economic prescription to phase out its piled-up debts through its Staff Monitored Program.

France, the host country, led by example and canceled Sudan’s $5 billion debt to the country and provided a $1.5 billion bridge loan to assist Sudan to clear its arrears to the IMF. Several other countries also pledged to remove Sudan’s debt burdens, including the country’s largest creditor, Kuwait, who dismissed a $9.8 billion debt.

France, the host country, led by example and canceled Sudan’s $5 billion debt to the country and provided a $1.5 billion bridge loan to assist Sudan to clear its arrears to the IMF. Several other countries also pledged to remove Sudan’s debt burdens, including the country’s largest creditor, Kuwait, who dismissed a $9.8 billion debt.

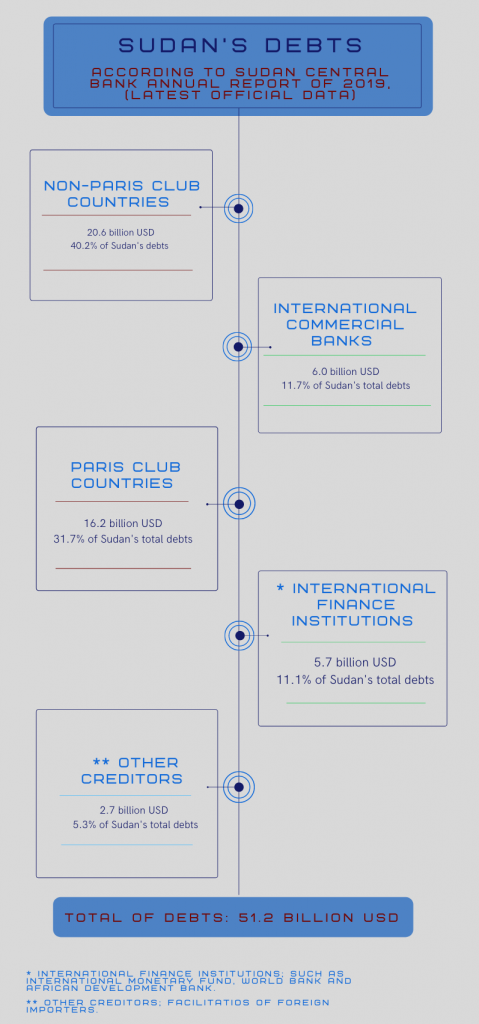

While the consortium of countries’ debt relief is significant, so is Sudan’s foreign debt. The IMF estimated in 2019 the country’s total debt was at least $50 billion, but some officials claim it could be as high as $60 Billion. Most of this vast debt accumulated under former dictator Omar al-Bashir’s regime with around 85% coming from arrears –unpaid interest and penalties.

“Thanks to these efforts […] to clear Sudan’s multilateral arrears, the way has been paved for the re-engagement of international financial institutions alongside Sudanese authorities, which could receive nearly $2 billion in donations over the short term,” according to a statement from the French government. Since Sudan’s name has been removed from all blacklists, a US Treasury representative at the conference said, the country should be able to access aid from international financial institutions and apply for relief via the IMF’s Highly Indebted Poor Countries Initiative (HIPC).

Investment Hopes

While Sudan introduced investment-ready project proposals in five fields during the summit, no new, concrete investment deals or plans were announced, according to a high-ranking delegate who was not authorized to speak to the press. Prior agreements were presented such as an announcement by the Canadian gold company, Orca Gold, to extend their investments in Sudan. While the president of General Electric for North and East Africa stated they are interested in establishing a power generation plant via hydroelectric power from Sudan’s Merowe Dam.

A closed meeting was held at the “Mouvement des Entreprises de France – MEDEF” attended by the premier, Minister of Investment, and around 15 – 20 French companies. This meeting was held instead of a social event to network between Sudanese businesspeople and European counterparts according to the above source.

On Monday, Prime Minister Abdallah Hamdok and Finance Minister Jibril Ibrahim met with the World Bank’s Vice-President, Hafez Ghanem at the premier’s office to discuss the bank’s investment projects in Sudan. Ghanem said the bank would finance US$ 2 billion this year in infrastructure projects and support for the displaced and returnees.

Staff Monitored Program

The conference helped launch the IMF’s Staff Monitored Program whereby the institution will assist in relieving Sudan’s debut burden and improve investment opportunities. In the long term, economists say, the initiative may improve the country’s economy. But in the short term, the same sources told Ayin, Sudan’s poor may face unprecedented economic challenges. While Sudanese citizenry struggled with the partial lifting of subsidies and unifying exchange rates –this struggle may increase if the IMF follows its prescribed economic reforms further by lifting medical subsidies and liberating custom exchange rates.

“Sudanese people should expect more pressure from the IMF,” says veteran journalist and political analyst Mahjoub Mohammed Salih. The IMF’s Staff Monitored Program was designed to help qualify Sudan for the Highly Indebted Poor Countries (HIPC) initiative, Salih told Ayin. Authorities partially followed the IMF’s prescription policies to achieve this without causing a public outcry, “but after 30 June, the IMF will demand the government to implement a complete liberation of the exchange rate.” This, Salih says, may increase market prices tenfold for imported goods.

This drastic change is to be partially cushioned by Sudan’s Family Support Program but economists believe this support is too little for too many. With Sudan’s consistent inflation, economists say, the targeted population will only receive US$ 5 per person.

Foreign vs national solutions

“The Sudanese government relies completely on foreign solutions instead of a national plan, it keeps repeating that it inherited a dire economic crisis, but this excuse is exhausted, and in fact, they have created a far worse situation,” says economist Dr. Khalid El Tijani. “This situation is very dangerous as the constant pressure on people might lead to an explosion.” According to Tijani, the foreign plan should have been a complimentary step to national reform – not the key solution.

Instead, Salih said, the government is relying on a “notorious IMF prescription” that has been tried countless times before in third world countries and leads “the economy to be controlled by market powers and crushes poor people.”

Several economists told Ayin that Sudan’s economic reform strategy could have utilized its resource production revenue better to soften the blow against citizens. Gold exports, for example, are almost 90 tons a year and yet state revenue from the trade remains minimal with estimated global trade losses as high as US$ 5.7 billion, according to a 2020 study.

“There’s needed integrity in the export sector — the income doesn’t come to the country but instead goes to individuals abroad,” Salih added. Since coming to power, Salih says, the government has not used this time to eradicate corruption. “Sudan is governed by one government, not two; and this government is responsible to put national resources and exports in the hands of the financial authority.”

Another key potential resource for the government stems from money transfers from Sudan’s expansive diaspora, estimated at US$ 6 – 8 billion per year. “If this money went through a proper and efficient banking system, it could benefit the country, the current banking system in Sudan is not trustworthy,” said the conference delegate, adding that he expects reforms in the banking sector after the conference. The delegate added that the government must reform the taxing system, one of the lowest in the country at around 7% compared to the 15% regional average.

The potential for future public unrest against the government seems likely, Salih says, given that the economic reform plan was never presented to them. “One of the biggest problems of this government is its silence and leaving people to speculates regarding its agenda, which creates distrust and resentment –this could lead to serious tensions.” More government transparency and the involvement of the public in the countries’ economic reform agenda may place Sudan in the right direction, the delegate added. “The hope is for Sudan to have a clear national vision and strategy.”